Future of ABSD: Addressing the Long-Term Resilience of CCR Properties

- ERA Singapore

- 6 min read

- Blog

- 28 Aug 2025

The Core Central Region (CCR) has long stood as the epicenter of luxury living. With close proximity to the Central Business District (CBD), high-end shopping malls and top-tier lifestyle amenities, it has held a reputation for being an exclusive ground for foreign buyers. With the introduction of high ABSD rates, there has been a huge shift in the CCR market, affecting both demand and supply side dynamics of the market.

At the same time, luxury home sales rose in 1H 2025, as growing economic uncertainty saw SPRs and foreign buyers turning to Singapore’s prime properties as a flight-to-safety strategy.

Narrowing price gap between CCR and RCR – A reaction to ABSD hike

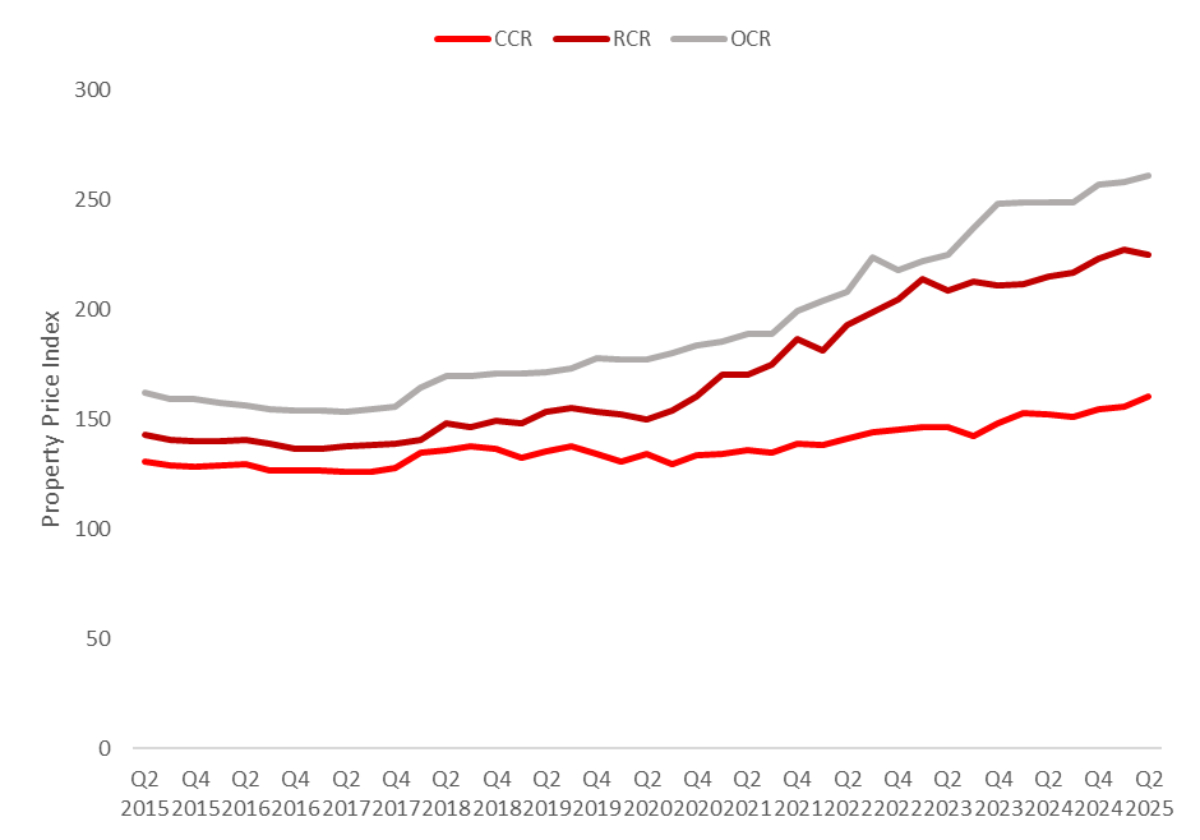

Over the years, developer activity has heightened in the RCR and OCR, where there is more availability of buildable plots and rise of new urban growth potential. Coupled with rising construction costs, we can observe that both the OCR and RCR have experienced more price growth. Conversely, the high ABSD rate, particularly the 60% rate on foreigners as discussed previously in Part 1 of the article series, has led to a relatively sluggish growth post April 2023.

Chart 1: Property Price Index per market segment (Q2 2015 – Q1 2025)

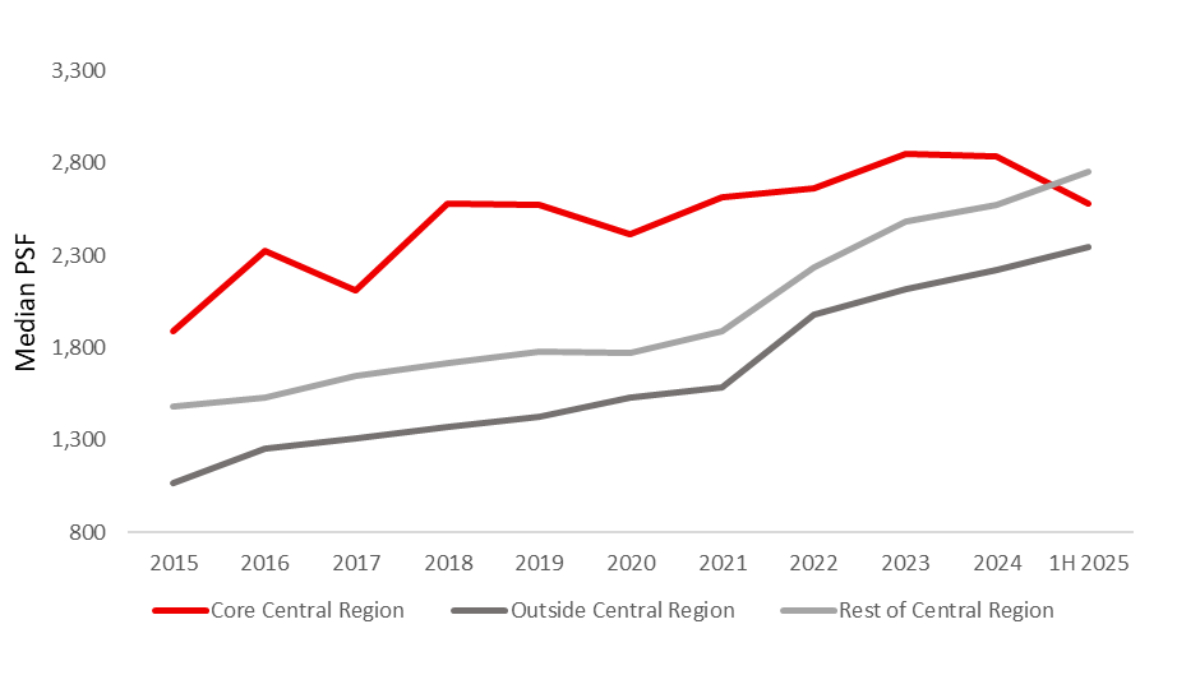

Traditionally, Singapore’s CCR properties has consistently commanded a sizable price premium compared to the RCR, with the gap often exceeding 40% between 2016 and 2019. This gap reflects the CCR’s prestige and the allure of living in the city centre. However, this price gap has been narrowing, and as of 1H 2025, the RCR has surpassed the CCR in median unit prices by 6.2%. This also shows how the increase in ABSD has not only just cooled demand in the CCR, but also nudged buyers towards purchasing properties in more decentralised areas.

Chart 2: Median new sale transaction prices by year for 99-year leasehold (non-landed) homes

Developers pulling out all stops to draw Singaporeans to CCR, then what now for foreigners?

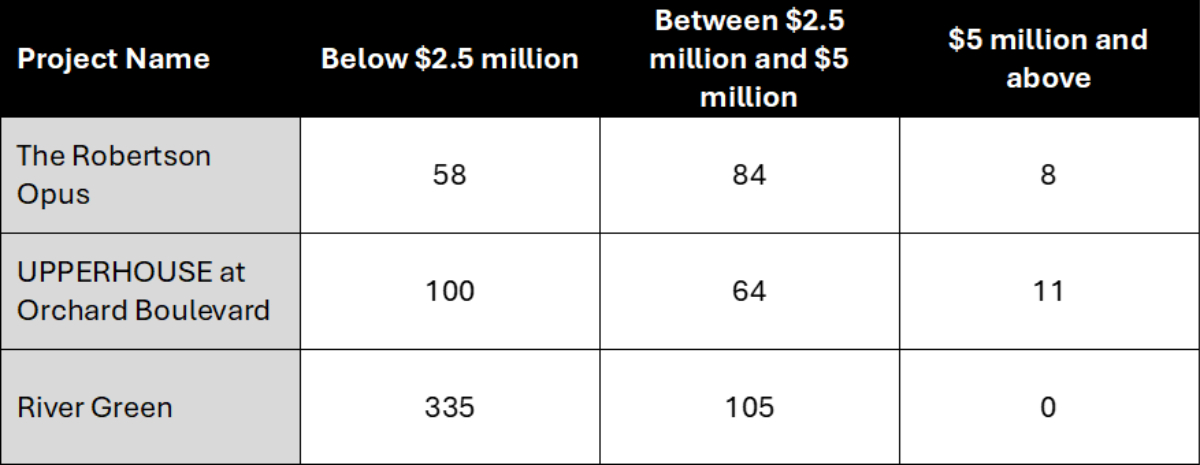

Recent new launches in 2025 have also signalled the strong value propositions of CCR projects. Developers are now leveraging on pricing strategies to attract local buyers amidst the high ABSD rate of 60% on foreigners. So far, the CCR’s new launch projects have been concentrated in Prime Districts, namely Districts 9 and 10. The bulk of the units sold for the three launch projects in the CCR also featured a significant proportion of units priced below $2.5 million; this signals a palatable pricing bracket for domestic demand, while also sustaining sales momentum in a market where foreign participation is suppressed.

However, CCR’s traditional appeal to foreign buyers – especially middle-class PMETS seeking long term residence – might be deterred due to the persistent high ABSD rate for purchasing a first residential property. In the long run, this may also have implications on the dynamism of our labour force, and our attractiveness as a destination for Foreign Direct Investments.

Table 1: Breakdown of units sold for CCR launches in 2025

But with CCR land price reaching a new high, will future CCR homes be out of reach for HDB upgraders or middle-class Singaporeans?

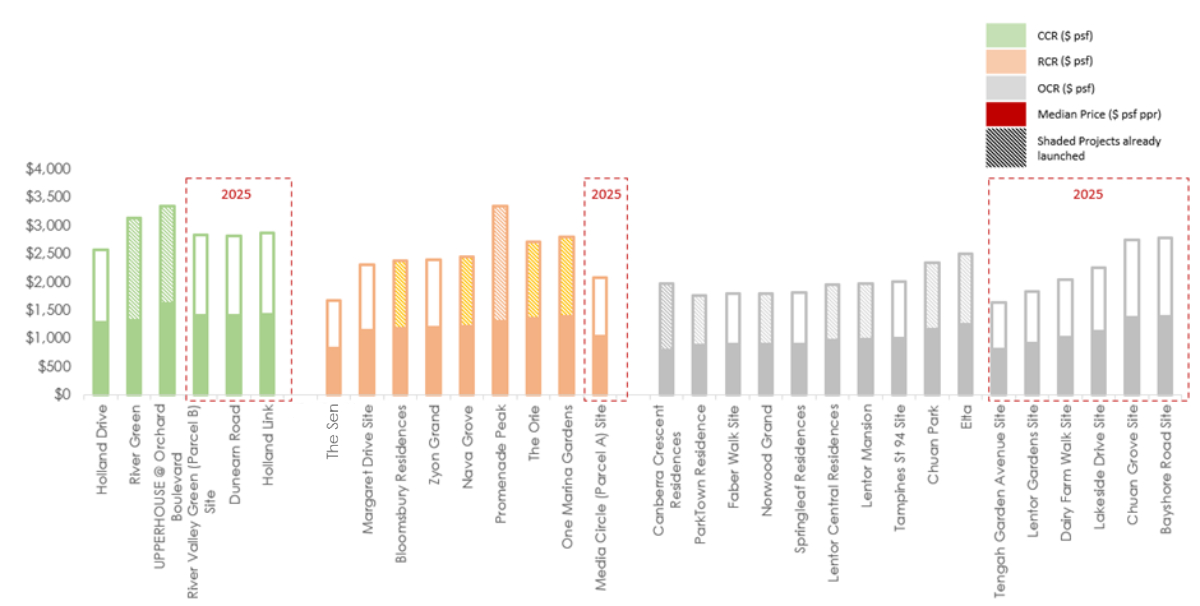

Latest GLS bid prices revealed that the CCR continues to command a premium with a median land bid price of $1,415 psf ppr, despite the presence of the 60% ABSD on foreign buyers. Recent bidding activity in the CCR includes a Holland Link site which drew 5 bids with a top offer of $1,432 psf ppr, as well as in June, where a Dunearn Road site was secured with a top bid of $1,410 psf ppr amidst 9 bidders. Such firm bidding activity can be attributed to the renewed confidence in CCR and a signal for broader recovery amidst the hike in ABSD rates.

However, with the new benchmark land prices, new launch prices are now averaging at a range of $2,500 to $3,000 psf launch pricing. Moving forward, it is expected that land prices will continue to climb, which could cause launch prices to exceed $3,000 psf on average. This then calls into question whether future launch projects in the CCR would still remain attainable for HDB upgraders or middle-class Singaporeans. With the high ABSD rate already suppressing foreign demand, this might result in the CCR market reverting to a subdued state similar to the immediate aftermath of April 2023’s ABSD revision.

For now, developers are mitigating such pressures through unit-mix and pricing strategies, offering smaller and more compact layouts to make quantum prices more appealing to locals. However, rising land prices in the CCR may require broader policy adjustments to sustain the market’s long-term resilience.

Chart 3: Benchmark Land Prices for GLS Sites and corresponding land prices

A tale of two segments in the CCR- Building Future Resilience

The CCR’s ability to navigate through these pressures can be better understood through its two evolving segments: the Central Business District (CBD) and the prime residential enclaves.

At the heart of the CCR, Singapore’s CBD is poised for further development to strengthen its position as both a global financial hub and a vibrant 24/7 destination via the Central Business District Initiative (CBDI).

Introduced in 2019, the CBDI encouraged the creation of mixed-use neighbourhoods through conversion of existing old office buildings. This also signals to developers and investors that the government is committed to rejuvenating the CCR, where the CBD is transformed via live-work-play hubs and more green spaces.

Other initiatives such as Pilot Business Improvement Districts (BIDs) have also encouraged private sector stakeholders to take collective ownership of the place management of their precincts. With these schemes integrated into Master Plan 2025, formerly office-dominated streets are evolving into dynamic mixed-use developments where work, leisure and lifestyle can converge.

Meanwhile, CCR’s prime residential districts continue to command prestige, built on the scarcity of freehold land, proximity to top schools, and nearness to the Orchard Road Shopping Belt. These districts will continue to attract long-term owner occupiers who purchase residential properties for wealth preservation and long-term capital preservation.

What can we look forward to?

While the heightened ABSD rates in has undeniably reshaped demand in the CCR, it has not diminished the CCR’s relevance in the residential property market today. The 60% ABSD has undoubtedly cooled foreign speculative buying and aligns with the goal of keeping housing accessible to Singaporeans. Yet, its application did showcase risks which sidelines skilled foreign professionals who would want to live long term in Singapore. The challenge now lies in balancing the trade-offs between preserving the deterrence effect, while providing calibrated pathways for foreigners who demonstrate a genuine commitment to working and living in Singapore.

Right now, Singapore’s CCR market has showcased that resilience is possible even in a high barrier to entry environment. While recent launches in the CCR have proven successful in 2025, with demand concentrated among Singaporeans and PRs, questions remain on whether such momentum can be sustained in the face of headwinds such as rising land costs.

As the CCR market continues to navigate the road ahead, opportunities can be explored to fine tune the prevailing ABSD policy so that it remains responsive to an evolving economic landscape and the housing aspirations of both locals and foreigners.

I confirm that I have read theprivacy policy and allow my information to be shared with this agent who may contact me later.