In response to the growing demand for housing and to address market

adjustments, the Singapore government has recently announced its third round of cooling measures, aimed at moderating investment demand through an increase in Additional Buyer’s Stamp Duty (ABSD)

rates for residential property.

Marcus Chu, CEO of APAC Realty & ERA Asia Pacific, said, “The revision of ABSD rates is expected to primarily impact foreign buyers. With Singapore’s property market being perceived as a stable and secure investment ground, it has witnessed a surge of foreign interest, which has driven up property prices, especially in private residential real estate, by 3.2% in Q1 2023, as compared to 0.4% in the previous

quarter. With the revised ABSD doubled for foreigners (from 30% to 60%), it may pose temporary challenges, but they are expected to pave the way for a more resilient and thriving residential real estate

market in the long run.”

The revision of ABSD rates across all are illustrated as follows:

| Additional Buyer’s Stamp Duty (ABSD) | Rates before 27 April 2023 | Rates on or after 27 April 2023 | |

| Singapore Citizens | First Residential Property | 0% | 0% |

| Second Residential Property | 17% | 20% ↑ | |

| Third Residential Property | 25% | 30% ↑ | |

| Permanent Residents | First Residential Property | 5% | 5% |

| Second Residential Property | 25% | 30% ↑ | |

| Third Residential Property | 30% | 35% ↑ | |

| Foreigners | Any Residential Property | 30% | 60% ↑ |

Source: MND, MOF, and MAS joint press release on 26 April 2023

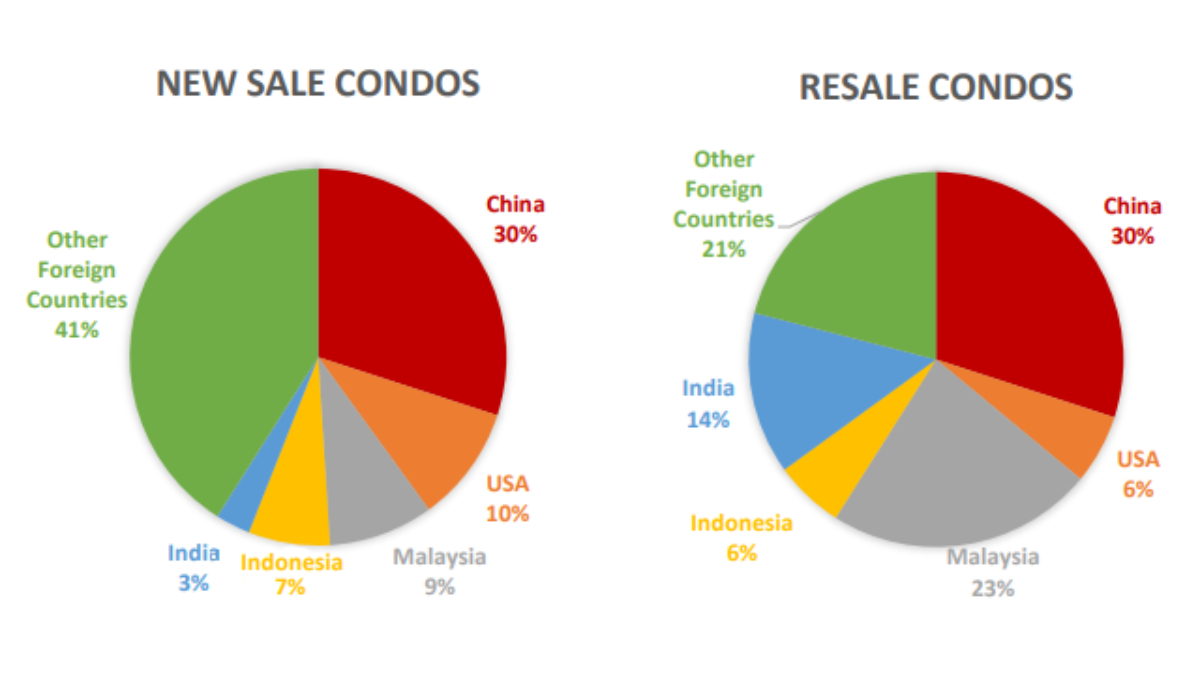

To delve deeper into the foreign buyers in the private residential segment, ERA’s Research and Market Intelligence has identified the top five purchasers based on the country and quantity of units bought in 2022:

Source: URA, ERA Research and Market Intelligence.

Source: URA, ERA Research and Market Intelligence.

With foreign buyers inflating prices in Singapore’s private property market, the revision of the ABSD rates aims to prioritise owner-occupied housing. The new measures would help stabilise property prices and ease the strain on tight rental and housing markets by boosting the housing supply. This is especially

important given the challenges posed by high mortgage interest rates, environmental and economic uncertainties, and the growing concerns around global uncertainties.

First-time buyers of residential properties in Singapore, mainly Singapore Citizens (SCs) and Singapore Permanent Residents (SPRs), will not be affected as there will be no changes in ABSD rates (0% and 5% respectively). These buyers make up 90% of all residential property transactions according to data from 2022.

Eugene Lim, Key Executive Officer of ERA Singapore, adds, “Investors and foreigners are likely to back down and re-evaluate their options, but as Singapore Citizens (SCs) and Singapore Permanent Residents (SPRs) first time buyers are not affected by this increase, we can expect them to be the key demand drivers in the months ahead.”