Singapore's Private Residential Market: How 2025 Made It Great Again!

- Egan Mah and Kwong Seong Ping

- 10 min read

- Research

- 8 Dec 2025

Market Outlook | 2026

How 2025 Made the Private Residential Market Great Again!

The bigger question is - if the momentum will sustain through into 2026

2025 proved to be an excellent year for the residential market despite various challenges, including trade tensions and the extended Seller Stamp Duty introduced along the way. Lower interest rates, stronger-than-expected economic growth, and rising HDB prices have helped mitigate the impact of impending economic uncertainty.

Although the market took a breather in the second quarter of 2025 following US President Trump’s announcement of reciprocal tariffs and a potential trade war, the slowdown was only temporary. The tariffs announced on 2 April 2025 during Liberation Day caused volatility in global financial markets, leading homebuyers to adopt a wait-and-see approach. The slowdown was further compounded by Singapore’s General Elections in May and the usual lull during the June holidays.

Nevertheless, the market was quick to regain momentum in the following months as sentiment stabilised and buyers returned once the implications of the tariffs became clearer.

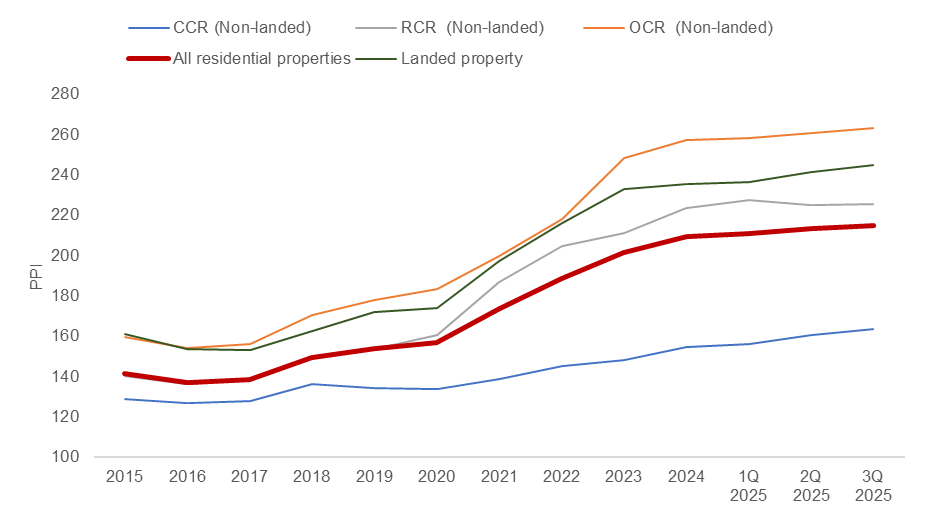

All Residential Price Index rose moderately, with growth led by the landed segment.

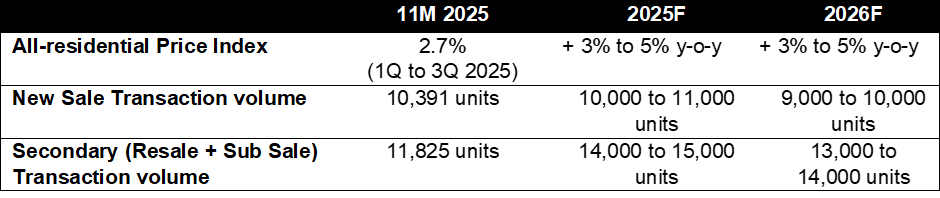

The All-Residential Price Index increased by 2.7% in total over the first three quarters of 2025. On average, prices rose by 0.9% quarter-on-quarter (q-o-q), compared with the 1.0% q-o-q pace seen in 2023.

As of 3Q 2025, the non-landed residential price index showed a cumulative 2.5% rise over the three quarters, while the landed homes price index performed more strongly, increasing by 4.0% in the same period.

Chart 1: Singapore Private Residential Price Index

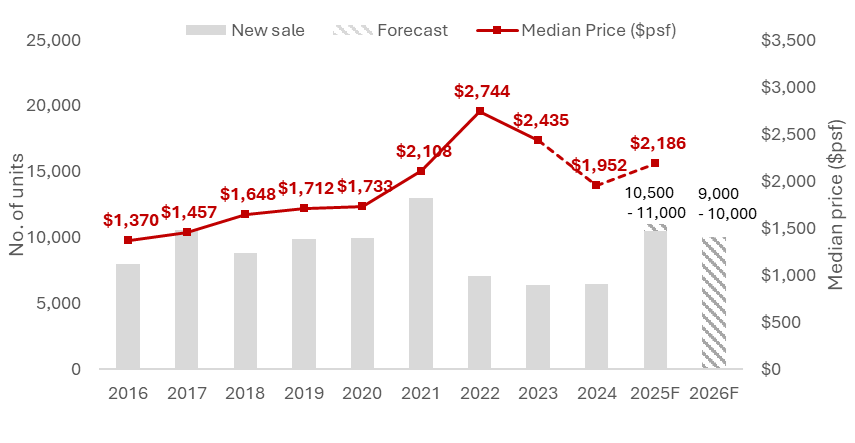

New home sales are at their highest since 2021, on the back of fewer TOP homes

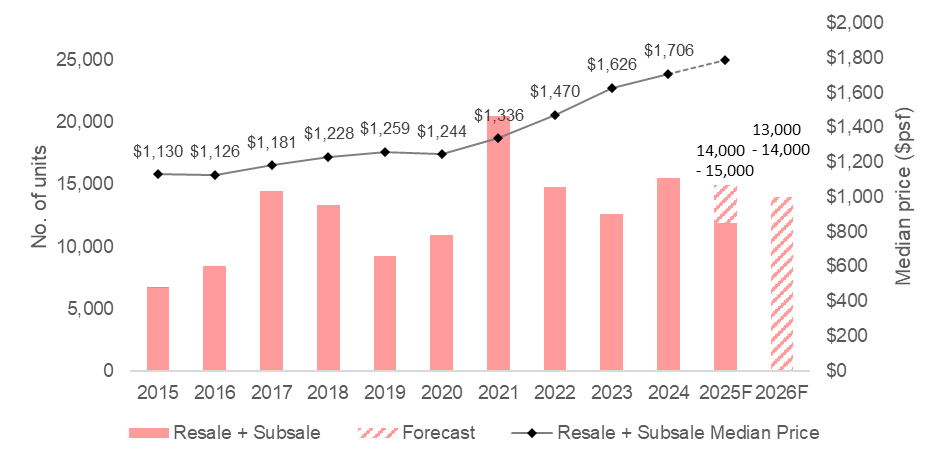

Despite these challenges, new home sales reached a peak not seen since 2021, surpassing 10,000 units in the first 11 months of 2025. Secondary transactions, including resale and subsale transactions, remained steady at 11,825 even amid a rise in new home transactions.

Chart 2: New Sale Transactions and Median Price

Chart 3: Resale & Subsale Transactions and Median Price

Overall, the residential market has delivered a remarkable 2025 report card despite increased uncertainty. In the next segment, ERA identified eight key moments that shaped the residential market in 2025.

Eight Key Trends That Shaped the Residential Market

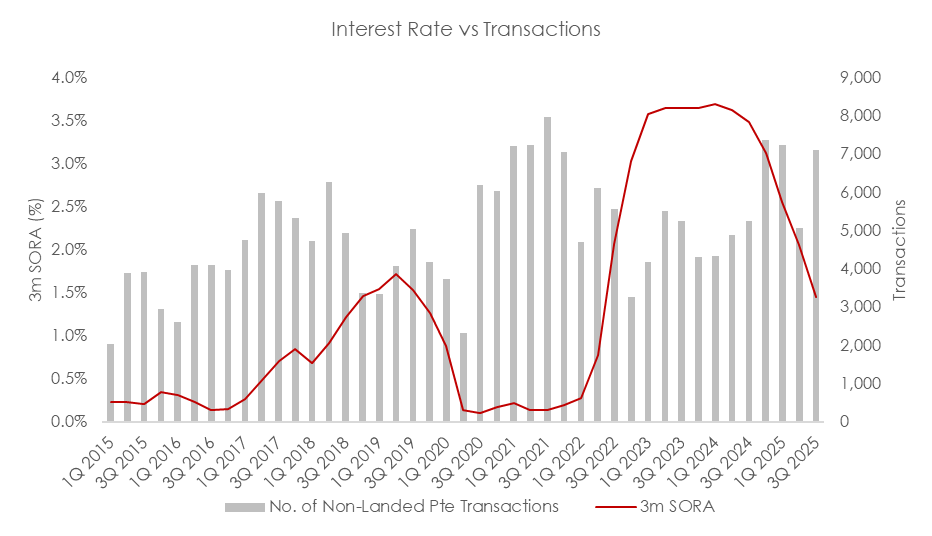

1.Easing interest rates helped to drive sales momentum

Firstly, the declining interest rate environment helped drive residential demand for 2025. After the first U.S. Federal Reserve (Fed) rate cut in September 2024, residential transactions surged. Two further rate cuts in September and October 2025 further reinforced buyer confidence and maintained the momentum in residential sales for 2025.

Chart 4: Non-landed transactions versus Interest Rate

2. Buyer confidence rises due to a better-than-expected economic outlook.

Although the Liberation Day announcement caused ripples in the market and triggered some knee-jerk reactions, the market quickly regained its footing, aided by the temporary pause on trade tariffs. Singapore, being among the least affected by trade tariffs, also experienced a swift recovery, largely supported by strong demand for chips and artificial intelligence (AI) technology.

Singapore’s economy gained momentum in the third quarter of 2025, expanding by 2.9% year-on-year (y-o-y). This has already exceeded earlier forecasts of 1.5% to 2% growth, which was clouded by concerns over ongoing US tariffs. Consequently, the Ministry of Trade and Industry (MTI) upgraded the full-year forecast for 2025 to be "around 4%."

Amid the economic expansion, the overall unemployment rate remained stable at 2% in September 2025. Both citizen and resident unemployment rates eased, according to the Labour Market Advance Release[1]. However, future sentiments around hiring and wage growth could still be dampened by the less optimistic economic outlook, weighed down by global uncertainties and trade tariffs. Even though retrenchment numbers in the first nine months of 2025 increased by 13.8% to 10,630, up from 9,340 in the same period last year, the overall unemployment rate remained at a low of 2.0% in Q3 2025.

Singapore continued to experience easing inflationary pressures. The Consumer Price Index in 3Q 2025 increased by 0.2% quarter-on-quarter. The inflation rate has remained steady, with quarterly growth fluctuating between 0% and 1% since 3Q 2023[2].

Despite concerns over rising household debt, which increased by 6.2% year-on-year in 2Q 2025, household net worth and residential property assets grew by 8.0% and 7.0% year-on-year respectively[3].

3. Longer and higher Seller Stamp Duty reduced speculative demand.

The Seller’s Stamp Duty (SSD) is not new to the Singapore property market. It was first implemented in 2010 to discourage short-term speculation by requiring homeowners to hold onto their properties for a minimum period before selling.

But in July 2025, the government announced a higher SSD and an extended Holding period for property owners, aiming to curb speculative demand further. This reversion to the pre-2017 SSD holding period of 4 years seeks to reduce speculative demand by decreasing the number of sellers who flip their homes after just 3 years.

Table 1: Seller Stamp Duty Schedule

Buyers today are required to hold onto their property for at least 4 years to avoid any taxes imposed. Nonetheless, Singapore homebuyers remained undeterred, signalling genuine intentions to buy a home rather than for short-term speculation.

Overall, Singapore buyers remain fundamentally prudent and view property as a long-term investment. Since many homebuyers are owner-occupiers, they are unlikely to be impacted by the SSD changes.

4.Rising HDB Prices Motivate Aspiring Upgraders

Although the HDB Resale Price Index experienced a modest rise of only 0.4% in 3Q 2025, resale flat prices are still gradually increasing. This consistent growth has bolstered upgrading sentiment among aspiring private homeowners, encouraging them to proceed with their plans.

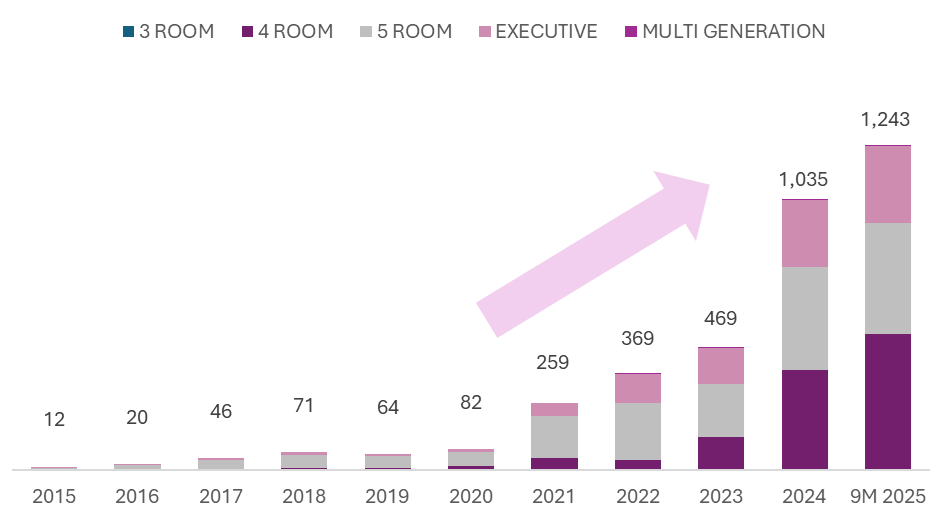

Chart 5: Million-dollar HDB transactions 2015 to 9M 2025

Million-dollar HDB transactions have also hit a new high this year, with 1,243 such deals recorded from January to September 2025. This already surpasses the full-year total of 1,035 million-dollar transactions in 2024. As more of these high-value deals occur, it allows a larger pool of HDB sellers to transition to private property.

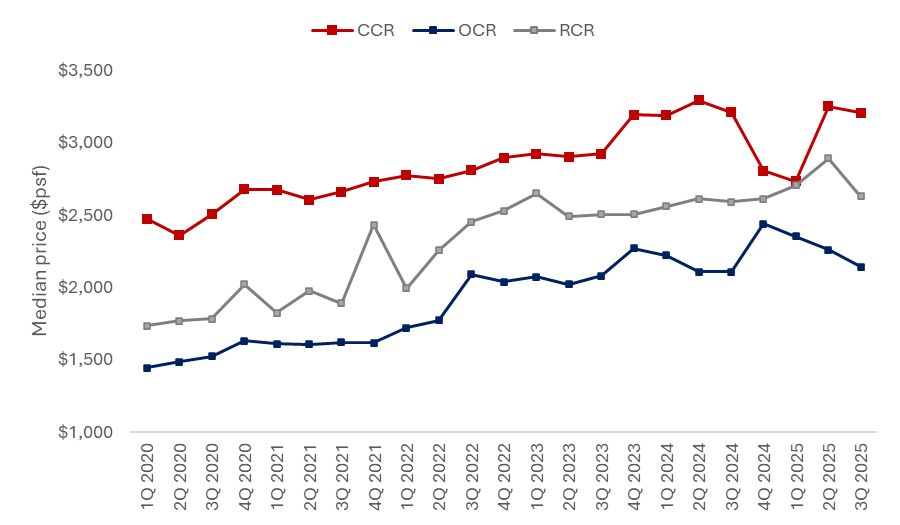

5.Opportunistic buyers flocked to CCR amid a narrow CCR-RCR price spread.

2025 presented a window of opportunity for homebuyers to enter the Core Central Region (CCR) market, given the narrow price gap. Some buyers took the leap and secured prime location new homes at competitive prices.

This explains why 2025 saw the recovery of CCR, even as local buyers continue to dominate the market. In a market mainly led by local buyers, where the Rest of Central Region (RCR) and Outside Central Region (OCR) often perform well, this is the first time in a while that two CCR projects have made it to the top 10 best-selling projects for 2025.

Chart 6: Median New Home Price by Market Segment

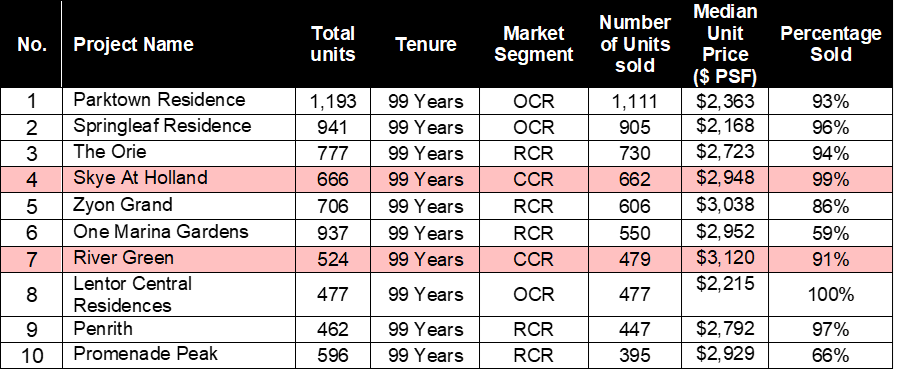

Table 2: Top 10 best-selling projects in 2025 by units sold

* Excludes ECs

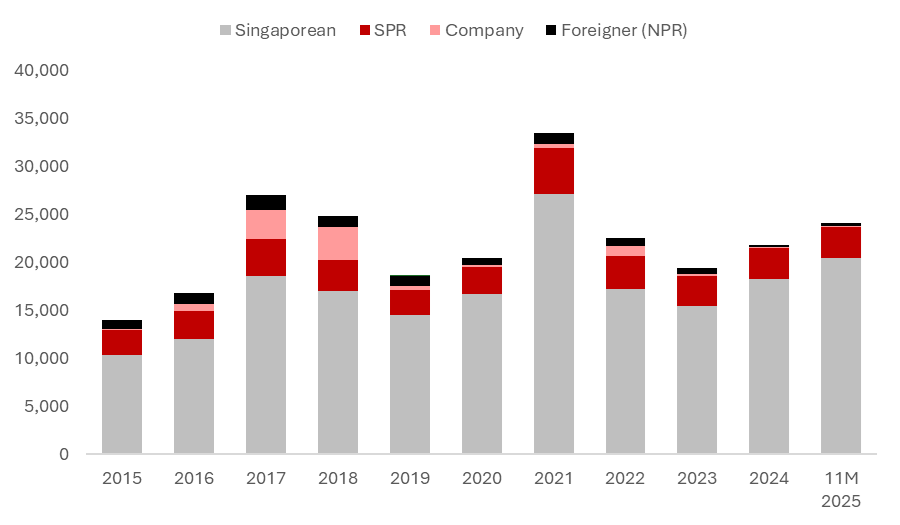

6. Foreign buyers remain sensitive to high ABSD; more are purchasing but not in large numbers.

Housing demand from foreigners remained subdued in 2025, largely due to the punitive 60% Additional Buyer’s Stamp Duty. Over 98.6% of residential property transactions were made by Singaporeans and Singapore Permanent Residents (SPR).

Chart 7: Buyer profile

7. Fewer completions saw spillover demand into the new home market.

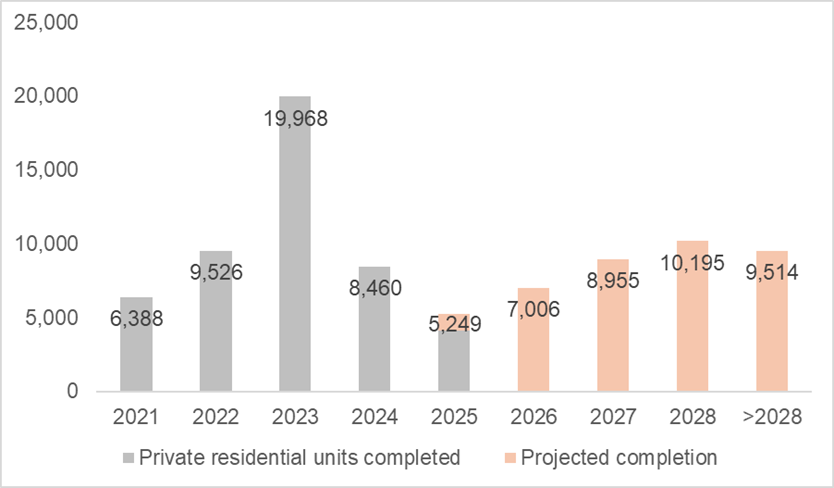

New home completions declined in the second year, dropping approximately 38.0% y-o-y, with only 5,249 units expected to be finished in 2025. This marks a significant decrease since the peak in 2023, when 19,968 units were completed.

Similarly, we anticipate a moderate rise in completions in 2026, but the supply of newly finished homes remains limited. In short, even with this slight increase in 2026 completions, resale supply remains tight, and we could see more spillover demand into the new home market.

Chart 8: Private residential completions

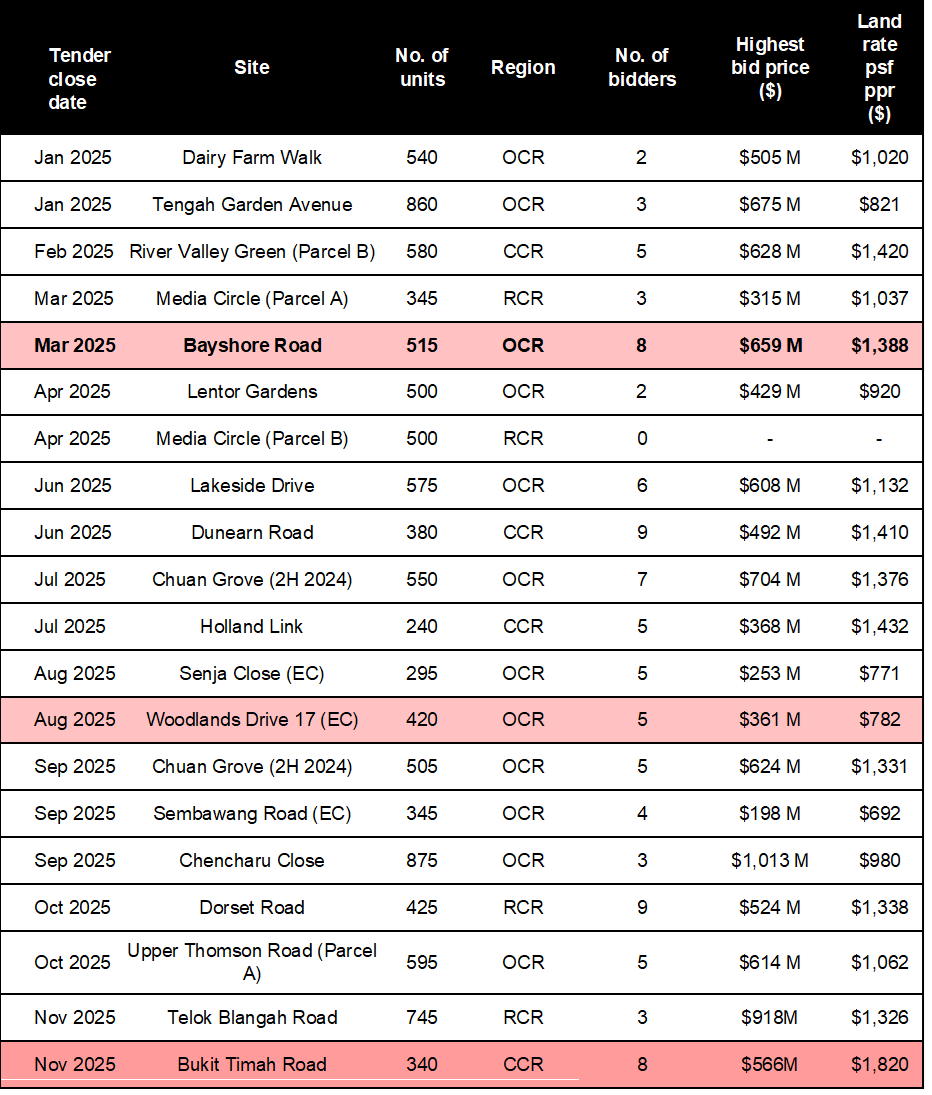

8. Land prices have hit a new peak.

In 2025, there are 20 sites on the Government Land Sales (GLS) Confirmed List, similar to 2024. It includes 16 private residential sites and four EC sites. In November and December 2025, three and four sites will be launched for tender, respectively.

As of 26 Nov 2025, a total of 16 private residential sites and three EC sites have been awarded. However, one site (Media Circle (Parcel B)) received no bids from developers.

Looking ahead, the private home supply (units in the Confirmed List) scheduled for 1H 2026 decreased marginally by 3.2% compared to 2H 2025 but remains 9.0% lower than the supply in 1H 2024. A total of nine sites are listed on the Confirmed List, including six private residential sites, one Commercial & Residential site, and two EC sites. It will consist of 4,575 units, including 635 EC units. Overall, the private home supply (units in the Confirmed List) slated for 1H 2026 fell marginally by 3.2% compared to 2H 2025 but remains 9.0% lower than the supply in 1H 2024.

Table 3: 2025 GLS Results

Strong buying fundamentals outweigh challenges – and this momentum is expected to persist into 2026, although it may be moderated by rising home prices

2025 proved to be a great year for Singapore’s private residential market, supported by resilient demand, a steady economic environment, and renewed confidence following easing global concerns. The key question now is whether this momentum can continue into 2026.

Despite lingering global uncertainties and ongoing shifts in trade and capital flows, Singapore continues to stand out as a stable and attractive investment hub. Singapore’s sustained push for innovation, its expanding network of trade partnerships, and its strong ability to attract long-term foreign investment will keep supporting job creation and economic growth, which are vital pillars underpinning the housing market.

That said, several pressure points are beginning to emerge. Rising land costs may reduce affordability for some HDB upgraders, while consistently strong new-home sales could increase the likelihood of further policy intervention. Nevertheless, these factors remain manageable within the backdrop of solid market fundamentals, such as prudent local buyers and a well-regulated housing environment.

Looking ahead, the private residential market is expected to remain resilient in 2026. The All-Residential Price Index is projected to see a moderate rise, supported by strong owner-occupier demand and continued right-sizing activity.

With another 19 private residential projects and 5 EC launches scheduled to debut, there will undoubtedly be options for every aspiring homeowner. However, this is fewer than 2025, which saw 24 private development and 2 ECs launches. Nonetheless, new home sales are forecasted to range between 9,000 and 10,000 units, while the secondary market is likely to see 13,000 to 14,000 resale and subsale transactions. This reflects stable underlying demand even as the market navigates selective pressure points.

Table 3: ERA forecast of Private Home Market

[1]Ministry of Manpower, Third Quarter 2025 Labour Market Advance Release

[2] Singstat, Percent Change In Consumer Price Index (CPI) Over Corresponding Period Of Previous Year, 2024 As Base Year

[3] Department of Statistics, Household Sector Balance Sheet, Second Quarter 2025

I confirm that I have read theprivacy policy and allow my information to be shared with this agent who may contact me later.