Since its implementation in 2007, the HDB Loan Eligibility (HLE) Letter has been an integral part of the flat-booking process in Singapore. But all that is set to change from May 9 onwards when its replacement, the new HDB Flat Eligibility Letter (or HFE), comes into play.

Intended to “provide flat applicants with greater convenience” by cutting down the number of eligibility checks involved in the flat-buying process, the HFE not only allows buyers to find out what financing options they qualify for, but also whether they are able to purchase an HDB or resale flat.

Read on for a breakdown of the HFE, the process of getting one, as well as recent announcements that homebuyers should take note of!

What is the HDB Flat Eligibility Letter (HFE)?

Just like the HLE before it, the HFE is an essential document that all homebuyers will need to make headways in their flat ownership journey. Presently, possession of a valid HFE letter is necessary when:

- Applying for a Built-to-Order (BTO) flat during a sales exercise.

- Obtaining an Option to Purchase (OTP) to purchase a resale HDB flat, as well as submitting a resale application.

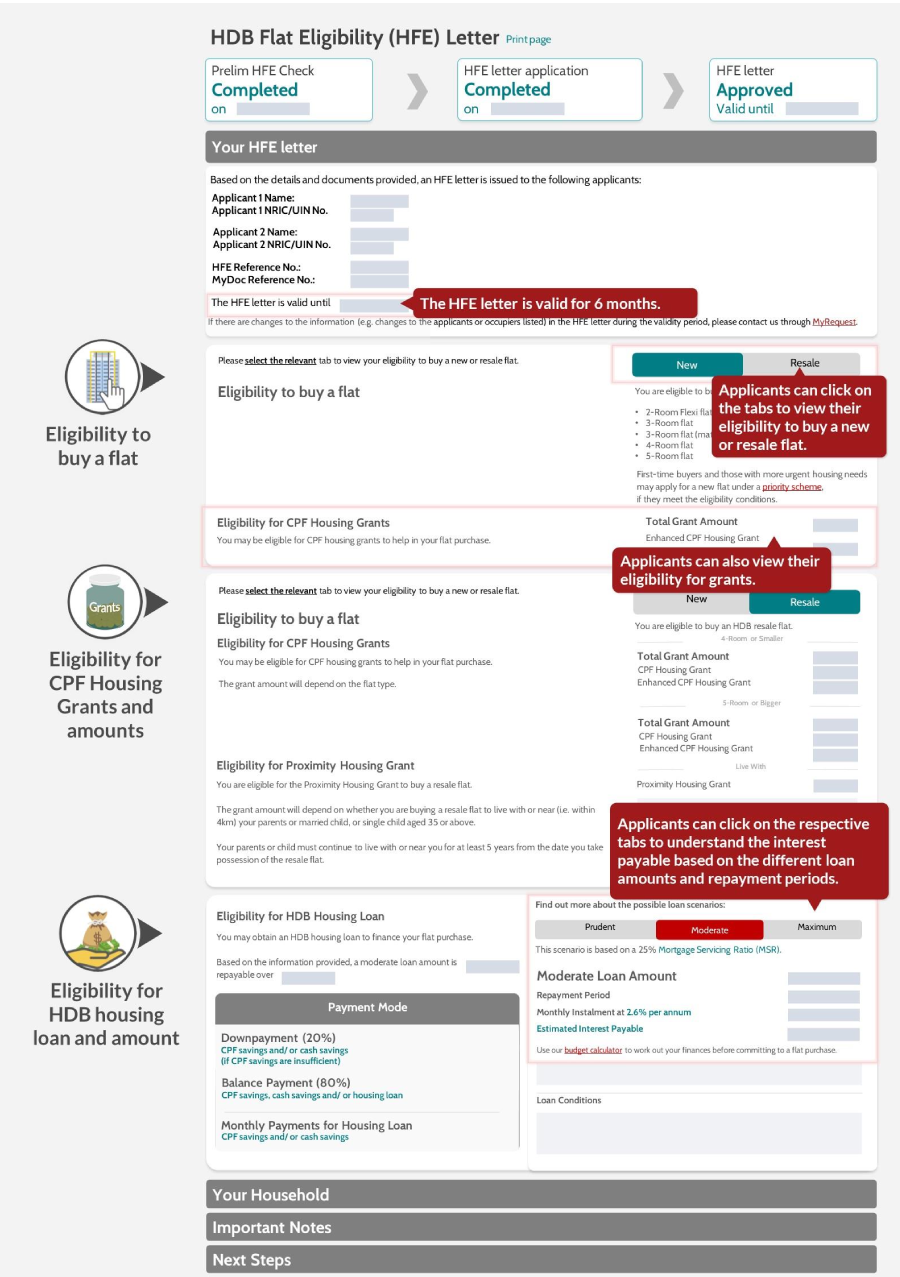

Similar to the HLE, each HFE is valid up to 6 months from the date of issue. It may also be worth noting that an income reassessment may be deemed necessary, if a) there are changes in household income and/or b) the applicants and occupiers listed within the HFE.

Similar to the HLE, each HFE is valid up to 6 months from the date of issue. It may also be worth noting that an income reassessment may be deemed necessary, if a) there are changes in household income and/or b) the applicants and occupiers listed within the HFE.

As for the HFE’s purpose, it serves to inform flat buyers about their eligibility to:

- Purchase a BTO flat or resale HDB flat.

- Obtain CPF grants, and also, the amount(s) they could receive.

- Acquire an HDB loan, as well as how much the loan amount will be.

Basically, this makes the HFE more than just a replacement for its predecessor.

Not only does the HFE make it simpler for homebuyers to determine which BTO or resale eligibility scheme they qualify under, it also makes it much easier for them to figure out the housing grand and loan amounts that they are eligible for.

Application process for HDB Flat Eligibility Letter

Much like how the HFE has made the path to flat ownership in Singapore easier, there are also new administrative procedures that make it less of a headache for to-be buyers to navigate through paperwork.

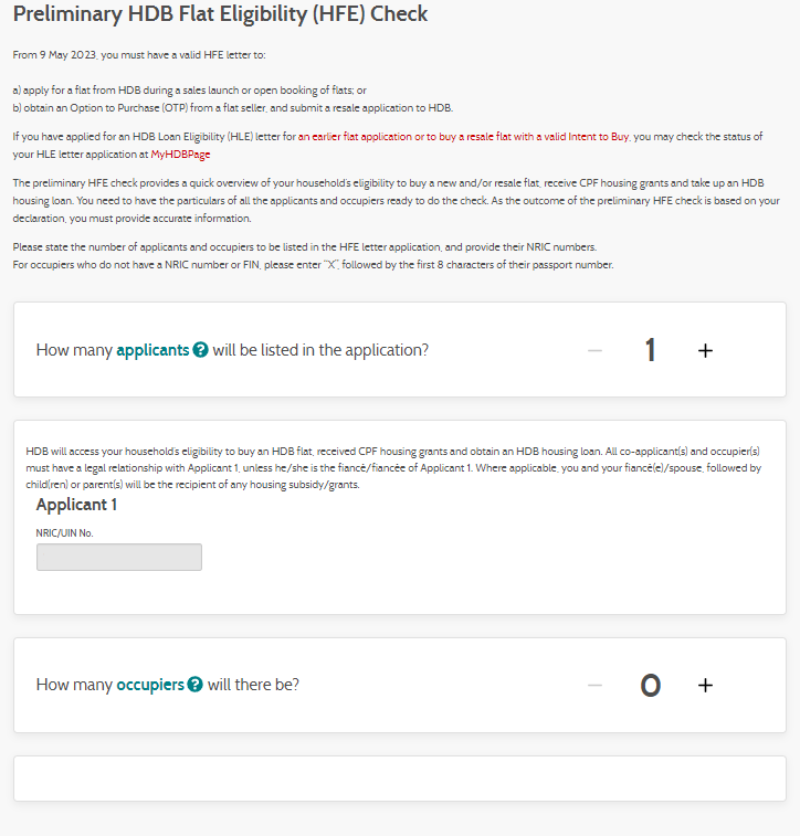

At present, there are only two actions required to acquire an HFE letter: first, undertaking a preliminary HFE check, and second, submitting an HFE application. Both of these steps can be completed by following guided processes on the HDB Flat Portal.

Step 1: Preliminary HFE check

After logging in to the HDB Flat Portal using their Singpass credentials and furnishing relevant details (e.g. number of occupiers, household income), applicants will be shown an initial assessment that outlines their eligibility for flat types, CPF grants and HDB loans.

Following this, applicants may either directly apply for an HFE letter or choose to continue the process at a later date – but they will have to do so within the next 30 days of completing the preliminary check.

Step 2: HFE letter application

Applying for the HFE itself will likewise require all applicants to login to the HDB Flat Portal, following which they will have to decide on the type of housing loan to finance their flat with (i.e. HDB loan or loan from a financial institution).

Applicants will also be prompted to provide their up-to-date particulars, CPF contributions over the last 15 months, as well as their latest Notice of Assessment from the Inland Revenue Authority of Singapore (IRAS) – all of which are retrievable using their Myinfo profile for Singpass users.

Upon completing the application, applicants will receive their HFE letter within 21 days with which they can apply for a flat during a sales launch or be granted an Option to Purchase for a resale flat.

Related changes: Income assessment period and housing grant disbursement

In tandem with the HFE letter announcement, HDB’s press release also outlined changes to the income assessment period for flat buyers as well as the sharing of housing grants amongst flat applicants and occupiers.

Income Assessment Period: Now standardised to 12 months

Prior to this round of HDB policy changes, applicants had their incomes assessed over a period of 3 to 6 months, but moving forward, their earnings will be reviewed over a 12-month timeframe.

This change will allow HDB to leverage on available data “for a more consistent assessment across applicants” especially those who have occupations with varying work requirements and pay scales.

Additionally, this new income assessment period will apply where relevant, including to buyers of Executive Condominiums, and HDB schemes such as the Lease Buyback Scheme and Silver Housing Bonus.

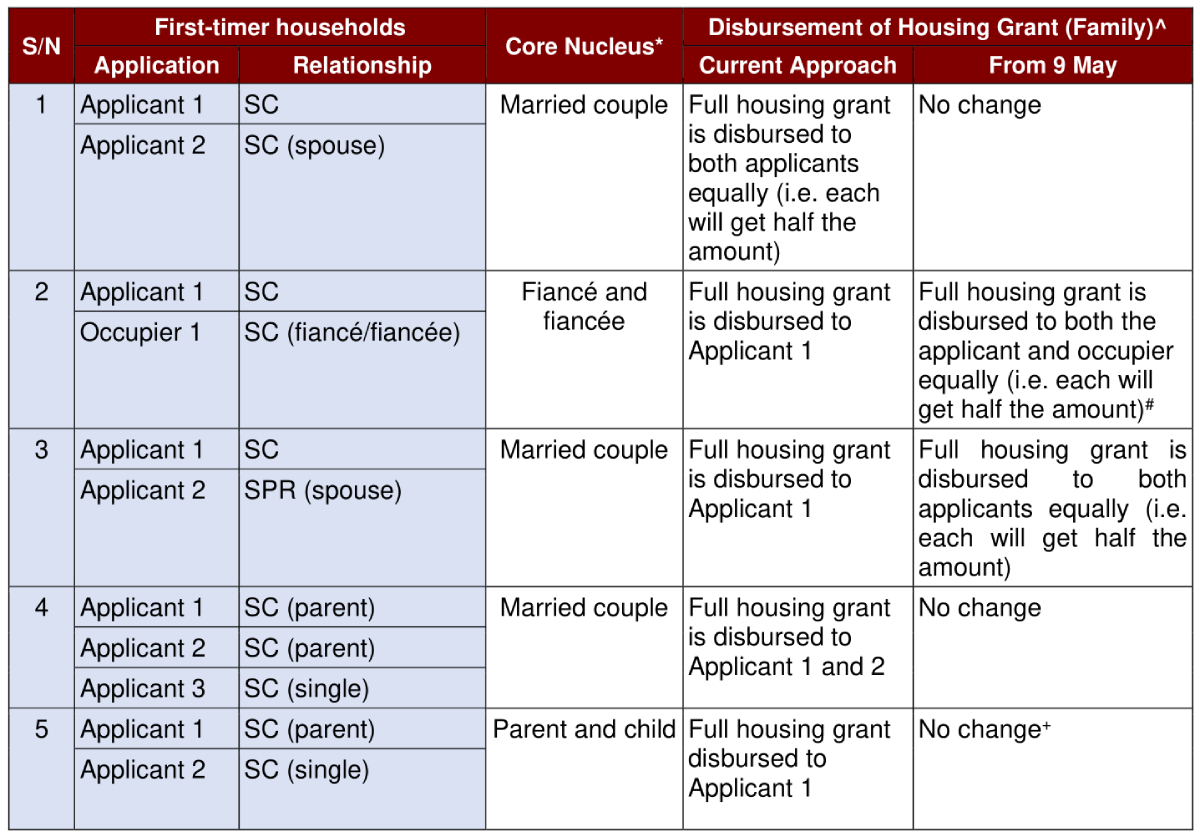

Equal disbursement of housing grants amongst household members

Going forth, households with a core nucleus comprising of a main applicant and an essential occupier will now have their housing grant shared 50/50 between them.

This marks a departure from prior practice that saw housing grants disbursed to only Singapore Citizen (SC) flat applicants. Furthermore, occupiers should take note that their portion of the CPF grant cannot be used for their current HDB flat purchase, and that it can only be utilised on a future HDB flat or EC purchase.

Disclaimer for consumers

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers.

For avoidance of doubt, ERA Realty Network and its salespersons accept no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.